JOHN C. BOGLE is founder and former chairman of the Vanguard Group of mutual funds and President of its Bogle Financial Markets Research Center. After creating Vanguard in 1974, he served as chairman and chief executive officer until 1996 and senior chairman until 2000. Bogle is the author of ten books, including Enough: True Measures of Money, Business, and Life, The Little Book of Common Sense Investing, and Clash of the Cultures: Investment vs. Speculation, all published by Wiley.

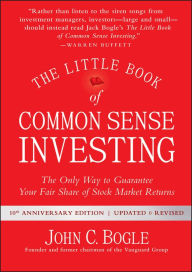

The Little Book of Common Sense Investing: The Only Way to Guarantee Your Fair Share of Stock Market Returns

Hardcover

(Updated and Revised)

- ISBN-13: 9781119404507

- Publisher: Wiley

- Publication date: 10/16/2017

- Series: Little Books. Big Profits

- Edition description: Updated and Revised

- Pages: 304

- Product dimensions: 5.30(w) x 6.90(h) x 1.30(d)

What People are Saying About This

Choose Expedited Delivery at checkout for delivery by. Wednesday, January 15

The best-selling investing "bible" offers new information, new insights, and new perspectives

The Little Book of Common Sense Investing is the classic guide to getting smart about the market. Legendary mutual fund pioneer John C. Bogle reveals his key to getting more out of investing: low-cost index funds. Bogle describes the simplest and most effective investment strategy for building wealth over the long term: buy and hold, at very low cost, a mutual fund that tracks a broad stock market Index such as the S&P 500.

While the stock market has tumbled and then soared since the first edition of Little Book of Common Sense was published in April 2007, Bogle’s investment principles have endured and served investors well. This tenth anniversary edition includes updated data and new information but maintains the same long-term perspective as in its predecessor.

Bogle has also added two new chapters designed to provide further guidance to investors: one on asset allocation, the other on retirement investing.

A portfolio focused on index funds is the only investment that effectively guarantees your fair share of stock market returns. This strategy is favored by Warren Buffett, who said this about Bogle: “If a statue is ever erected to honor the person who has done the most for American investors, the hands-down choice should be Jack Bogle. For decades, Jack has urged investors to invest in ultra-low-cost index funds. . . . Today, however, he has the satisfaction of knowing that he helped millions of investors realize far better returns on their savings than they otherwise would have earned. He is a hero to them and to me.”

Bogle shows you how to make index investing work for you and help you achieve your financial goals, and finds support from some of the world's best financial minds: not only Warren Buffett, but Benjamin Graham, Paul Samuelson, Burton Malkiel, Yale’s David Swensen, Cliff Asness of AQR, and many others.

This new edition of The Little Book of Common Sense Investing offers you the same solid strategy as its predecessor for building your financial future.

- Build a broadly diversified, low-cost portfolio without the risks of individual stocks, manager selection, or sector rotation.

- Forget the fads and marketing hype, and focus on what works in the real world.

- Understand that stock returns are generated by three sources (dividend yield, earnings growth, and change in market valuation) in order to establish rational expectations for stock returns over the coming decade.

- Recognize that in the long run, business reality trumps market expectations.

- Learn how to harness the magic of compounding returns while avoiding the tyranny of compounding costs.

While index investing allows you to sit back and let the market do the work for you, too many investors trade frantically, turning a winner’s game into a loser’s game. The Little Book of Common Sense Investing is a solid guidebook to your financial future.

Customers Who Bought This Item Also Bought

-

- The Warren Buffett Way

- by Robert G. Hagstrom

-

- A Random Walk Down Wall Street…

- by Burton G. Malkiel

-

- Beating the Street

- by Peter LynchJohn Rothchild

-

- Jim Cramer's Real Money:…

- by James J. Cramer

-

- The Four Pillars of Investing:…

- by William Bernstein

-

- Aftershock: Protect Yourself…

- by David WiedemerRobert A. WiedemerCindy S. Spitzer

-

- Fooled by Randomness: The…

- by Nassim Nicholas Taleb

-

- Investing 101

- by Kathy Kristof

-

- The Ultimate Day Trader: How…

- by Jacob Bernstein

-

- The Most Important Thing:…

- by Howard Marks

-

- Selling 101: What Every…

- by Zig Ziglar

-

- The Big Short: Inside the…

- by Michael Lewis

-

- Trading For Dummies

- by EpsteinAndreas Baaden

-

- The Only Investment Guide You&…

- by Andrew Tobias

-

- The Bogleheads' Guide to…

- by Taylor LarimoreMel LindauerRichard A. FerriLaura F. DoguJohn C. Bogle

-

- A Gift to My Children: A…

- by Jim Rogers

-

- The Money Culture

- by Michael Lewis

-

- All about Investing: The Easy…

- by Esme E. Faerber

Recently Viewed

"It's hard to argue with the eloquent logic of John C. Bogle's latest ode to index funds…Bogle's 'Little Book' offers much exemplary advice." (Bloomberg News, April 2007)

Among monetary gurus and wise men, John Bogle is a singular case. As the founder of the highly regarded Vanguard Group, he is revered for the company's commitment to providing value to its clients as well as profits to its investors. He even has his own group of fans, called "Bogleheads," who cling to every utterance and pronouncement from the great man.

In this latest entry in the Little Book series, Bogle's gentle prose contains idiot-proof advice for investors at all levels. He punctures the myth of the superiority of mutual funds and instead declares that by using a bit of common sense, low-cost index funds are the way to go for most modest stock investors. He's also wary of the ways of Wall Street and cautions investors to steer clear of its institutional con men and cautions against excessive fees and taxes that invariably eat up profits.

It's not very glamorous or exciting advice, but that's also his point: Slow and steady wins the race. (Miami Herald, April 9, 2007)

"genuinely provides investors with the ideal strategy for making the most of stock-market investing" (Motley Fool's UK website, March 8, 2007)

"It's an easy read that will, I suspect, quickly join Burton Malkiel's A Random Walk Down Wall Streetand Charles Ellis's Winning the Loser's Gameas one of the indexing crowd's favorite books."—Jonathan Clements (Wall Street Journal)

"It's hard to argue with the eloquent logic of John C. Bogle's latest ode to index funds." (Bloomberg Terminal, March 8, 2007).

"provides an opportunity to reflect on a remarkable career and legacy." (Financial Times, 19th March 2007)

"…it is John Bogle's hymn to index-tracking investment, and a fascinating read it is too." (Daily Telegraph, March 2007)

"Those who doubt my reasoning should read the Little Book of Common Sense Investing by John Bogle." (FT Adviser, 24th April 2007)

"…particularly interesting…goes some way towards discrediting the stockpicking virtues taught to me in my time as a financial journalist." (Fund Strategy, 7th May 2007)

"…wittily written, pocket-sized guide…If you want to learn how to avoid the unpredictabilities of the stock market and the fees of middle men, then this book is well worth a read." (Pensions Age, May 2007)

" ... For the individual investor, it presents a solid game plan for growing funds over the long haul." (Directorship, July 2007)

"... read Bogle's new Little Book of Common Sense Investingand you'll see how easy it is to beat the Alpha Hunters at their own game!" (MarketWatch, July 2007)

‘The one big thing that Bogle knows — and explains so well in this slender volume — is that buying and holding a broad benchmark of stocks while keeping fees to a minimum leads to higher long-term returns than constantly trading in a vain attempt to beat the market. Common sense? Yes. But radical too, as the entire investing establishment is designed to get investors to do the exact opposite.” (CNNMoney)

"Business books are often written by show-offs who want you to know all about their knowledge of the Greek tragedies and dark-coloured birds. So it was nice to get hold of the simply written Little Book of Common Sense Investing…Its author, John Bogle, in no simpleton. He built Vanguard into a huge fund manager...He is synonymous with index funds in the US. Vanguard's S&P 500 tracker is by far the world's largest mutual fund."—Stephen Cranston, Investor's Notebook (Jan 23, 2013)